KlimaTicket Ö

In order to become more sustainable in our thoughts, actions and solutions, we also need to change our mobility behaviour. In order to support this change and at the same time gain scientific knowledge, TU Wien promotes climate-friendly and resource-conserving behaviour with the financial subsidy for the KlimaTicket Ö, opens an external URL in a new window.

KlimaTicket Ö 2025 and 2026

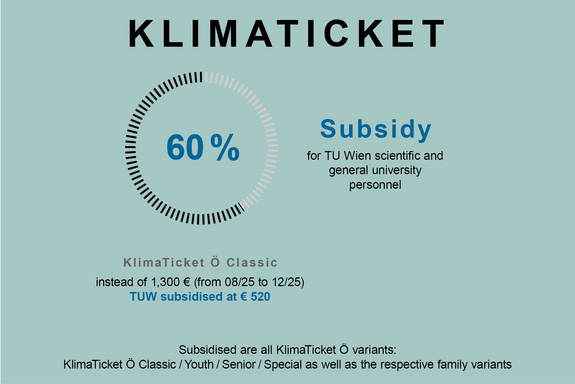

TU Wien will continue to promote the KlimaTicket Ö, opens an external URL in a new window in 2025 and 2026 and will support its employees financially. The subsidy in brief:

- 2025: 60% subsidy for TU Wien employees in scientific and general staff. Applications for tickets starting in 2025 can be submitted until January 11, 2026.

- 2026: approximately 55% subsidy for TU Wien employees in scientific and general staff

- 100% subsidy for TU Wien apprentices

- All variants of the KlimaTicket Ö are subsidised: KlimaTicket Ö Classic / Youth / Senior / Special as well as the respective family variants.

- Tickets with a validity period of 2026 can be submitted from 15 December 2025 to 10 January 2027.

Be sure to read the FAQs below before purchasing the KlimaTicket Ö. This will ensure that you know all the eligibility criteria for your ticket.

FAQs

Basic

Only the KlimaTicket Ö, opens an external URL in a new window with a term starting in 2025 and a one-off payment and a remaining term of at least six months at the time of application is eligible for funding.

Tickets with a validity period of 2026 can be submitted from 15 December 2025 to 10 January 2027.

Other tickets (e.g. KlimaTicket Metropolregion, Jahreskarte Wien etc.) are not subsidized, nor is the KlimaTicket Ö for monthly payment.

All persons, including civil servants, who have an ongoing employment relationship with TU Wien, provided that the employment relationship has a duration of at least six months at the time of application, is not on parental leave and the extent of employment is at least twelve hours per week.

Tutors can apply for funding as soon as they are employed at TU Wien for a subsequent 2nd semester at the time of application and the employment level is at least twelve hours in both semesters. Funding will only be granted after submission of the course registration.

In 2025, the subsidy will be 60%, and in 2026, 55%.

Apprentices will be reimbursed the full purchase price.

Applications for tickets with a validity start date of 2025 can be submitted up to and including January 11, 2026; one week later, on January 18, 2026, all remaining applications from 2025 will be deleted from the system. Tickets with a validity period of 2026 can be submitted from 15 December 2025 to 10 January 2027.

Regardless of when the application is submitted, the KlimaTicket Ö is valid for twelve months.

Important note! Please make sure you purchase your ticket in good time - as exceptions to the rule on applications are not possible.

The application is made via SAP-Services, opens an external URL in a new window, tile “Finances”, item “KlimaTicket”.

- a copy of the invoice showing the value and duration of the ticket and the cardholder

or - a proof of payment together with a copy of the final KlimaTicket Ö (the provisional ticket is not sufficient!)

The eligibility of your ticket is linked to the one-off payment. Tickets paid for in monthly installments are not eligible.

If you need to change your climate ticket to a one-off payment, we recommend that you cancel the existing ticket first and then purchase a new ticket via the website www.klimaticket.at. Please note that the cancellation, even for tickets purchased via Wiener Linien, must be made via the contact form at www.klimaticket.at (Link, opens an external URL in a new window).

Questions about the employment relationship

The employment relationship must last at least six months at the time of application and the employment must be for at least twelve hours per week. Furthermore, the KlimaTicket Ö, opens an external URL in a new window must still be valid for at least six months at this time.

Tutors can apply for funding as soon as they are employed at TU Wien for a further, subsequent 2nd semester and the employment level is at least twelve hours. Funding will only be granted after the submission of the notification of attendance.

No, only the values recorded in the SAP master data count. An application is only permitted if the requirements are met here. A possible extension at a later date that has not been recorded will not be taken into account.

No, if the requirements are not fully met, funding is not possible.

During parental leave (e.g. parental leave, educational leave, sabbatical, phased retirement) it is not possible to apply, but it is possible before parental leave begins or after it ends. However, an application is permitted during the employment ban due to pregnancy.

No, only employees receive funding. An ongoing employment relationship with TU Wien with at least twelve hours/week is required.

The ticket remains valid, there is no need to reimburse a proportionate amount of the funding, nor are there any consequences in terms of taxes or social security.

No, there is not. The KlimaTicket Ö is still valid. The subsidy does not have to be repaid, but a non-cash benefit is recognized for the period of validity after the end of the employment relationship (see FAQ: Financial matters / Taxes / Commuter allowance).

Questions about the KlimaTicket Ö

As long as the start of validity is in 2025 btw 2026 and the other requirements are met, the ticket can be subsidized.

No, this is not necessary. However, a non-cash benefit is recognized for the period of validity before the start of employment (see FAQ: Financial matters / Taxes / Commuter allowance).

The KlimaTicket Ö must be purchased as a one-off payment. A monthly payment and the associated monthly subsidy is unfortunately not feasible due to the organizational and administrative effort involved.

Colleagues who have difficulties with the one-off payment receive support at klimaticket@tuwien.ac.at.

No, only tickets with a validity start date of 2025 (2026) are eligible. The invoice date is irrelevant for the assessment.

No, only one subsidy is possible within a calendar year. Once the application has been successfully submitted, the SAP Services tile is blocked by the system.

Financial matters / Taxes / Commuter allowance

Yes, the ticket must be purchased first. The subsidy application can then be submitted with the invoice/proof of payment in SAP Services (“Finance” tile, Climate Ticket item).

Open the “Outbox” tile in SAP Services and select the “Klimaticket” line. Here you will find the “Workflow log” at the top of the screen, which contains the current status of your request. If you require further assistance, our colleagues in SAP-Support and Kreditorenbuchhaltung will be happy to help you.

If the KlimaTicket Ö is regarded as a job ticket within the meaning of § 26 Z 5 EStG 1988 EstG 1988, neither social security contributions nor wage tax are payable. In this case, the subsidy also does not count as income from employment.

However, if the validity of the KlimaTicket Ö extends to periods outside the employment relationship at TU Wien, a taxable benefit in kind must be recognized.

A non-cash benefit increases the calculation basis for wage tax, and sometimes also for social security contributions. Depending on the personal situation, wage tax and social security contributions may therefore have to be paid.

If the KlimaTicket Ö is already valid before the start of employment, the benefit in kind is due in the first month of employment. If the validity of the ticket extends beyond the end of the employment relationship, the non-cash benefit is due in the last month. In any case, no remuneration in kind is due at the start of parental leave or maternity leave.

Colleagues who are financially unable to make the one-off payment can contact klimaticket@tuwien.ac.at for support.

The commuter allowance is reduced by the amount of the subsidy. For this purpose, the annual amounts are divided by twelve and the value of the lump sum calculated in this way is reduced by the monthly amount of the subsidy to a minimum value of zero. In any case, the commuter euro continues to be paid in full.

Example:

- commuter lump sum EUR 696.00/12 = EUR 58.00 per month

- subsidy EUR 707.58 (60% of EUR 1,179.30 KlimaTicket Ö classic)

- EUR 707.58/12 = EUR 58.97 per month

- EUR 58.00 - EUR 58.97 = -0.97

The commuter allowance is therefore reduced to EUR 0.00, as a negative value is not permitted.

The following applies to contract staff and civil servants:

The travel allowance must be discontinued on the first day of the month following the start of validity of the climate ticket, or on the start of validity if this falls on the first day of the month. Please note that the “old” travel allowance may not be revived. This regulation only applies to climate tickets from the start of validity in 2025 (2026).

The following applies to employees covered by collective agreements:

The travel allowance is paid out in full, but a comparative calculation must be made. Here, the subsidy plus the travel allowance are compared with the cheapest comparable ticket for the route home – workplace – home. If the payments exceed the value of the comparative ticket, the excess amount must be subject to social security contributions (higher social security contributions are therefore due).

Third-party funding and apprenticeship top-up payments

Here too, 60% of the funding is paid from the global budget.

Yes, third-party funds can be used to pay exactly 100% of the ticket price. It is not possible to pay a different percentage of the costs.

No, as soon as the refund has been completed, the application tile is blocked and a subsequent increase is no longer possible.

No, internal offsetting is not possible.

No, from 2025 the granting of job tickets will be limited to the variants of the KlimaTicket Ö.

Apprentices receive their own checkbox as part of the application process, which enables them to submit an uncomplicated application.

Contact addresses

If you have any further questions, please do not hesitate to contact the colleagues in the respective departments:

- for organizational questions, ambiguities in the interpretation of the requirements and reasons for exclusion, please contact klimaticket@tuwien.ac.at

- if you have problems with the SAP Services tile, please contact sap-support@tuwien.ac.at sap-support@tuwien.ac.at

- if you have any questions about the transfer status of your grant, please contact kreditorenbuchhaltung@tuwien.ac.at

- if you have any questions about tax, social security, commuter allowance and travel allowance, please contact personalverrechnung@tuwien.ac.at.